Summarize with AI:

Gold Is the Largest RWA Onchain, and the Most Underutilized

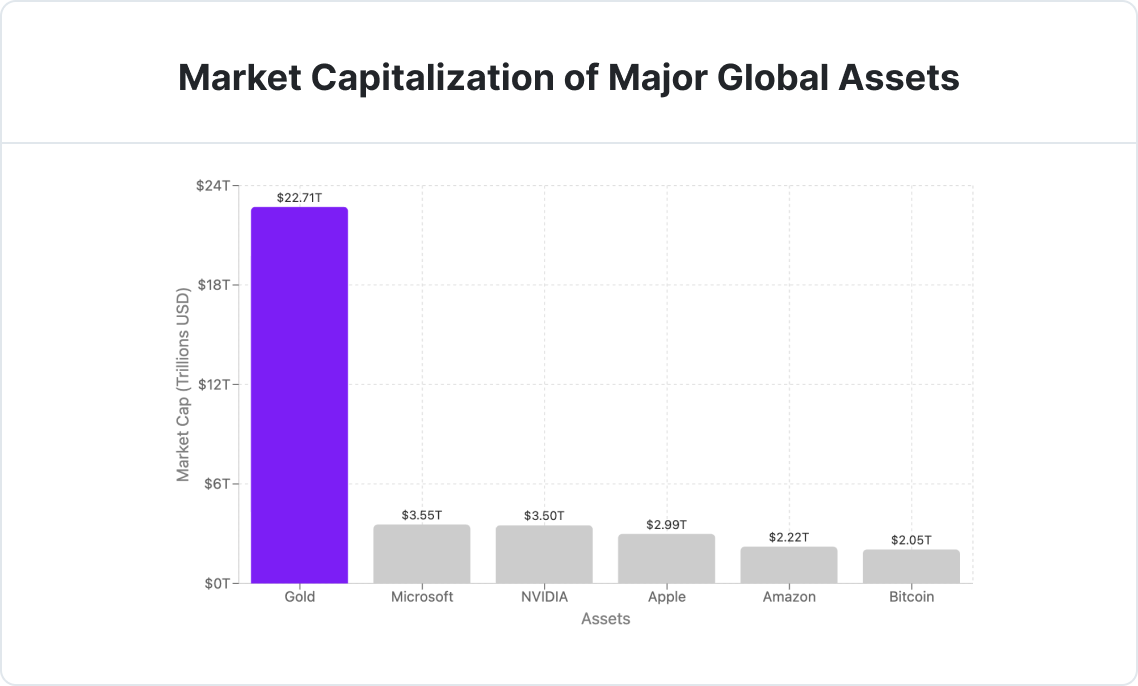

Gold outpaces all assets with a global market capitalization of over $23 trillion.

Gold is the most valuable real-world asset (RWA) on Earth. With a total global market capitalization of over $23 trillion, it outpaces all other physical and financial commodities by a wide margin. Trusted for centuries as a hedge, reserve, and store of value, gold is deeply embedded in institutional portfolios, central bank reserves, and cultural psychology across continents.

But gold is not just a legacy asset—it’s entering a new phase. Its tokenized form is gaining traction, offering 24/7 access, fractional ownership, and digital mobility. As of April 2025, tokenized gold surpassed $2 billion in market cap, making it the largest tokenized commodity in crypto.

And yet, despite this momentum, it remains largely idle onchain.

What Makes Gold an Ideal RWA?

Gold checks every box: deep liquidity, physical backing, institutional trust, and global price transparency. As a tokenized asset, it offers fractional access, borderless settlement, and 24/7 availability—making it a natural fit for DeFi protocols and onchain treasury strategies.

So why isn’t more of it being used?

The Problem: Tokenized Gold Is Inert Capital

From $1.2B in January to $2.0B in April, tokenized gold doubled in Q1 2025 alone. But less than 15% of that capital is actively deployed in DeFi. Tokens like PAXG and XAUT are custodial, non-yielding, and rarely integrated into lending markets, DEXs, or structured strategies. With no embedded incentives, users simply hold and holding isn’t enough.

The Opportunity: From Store of Value to Source of Yield

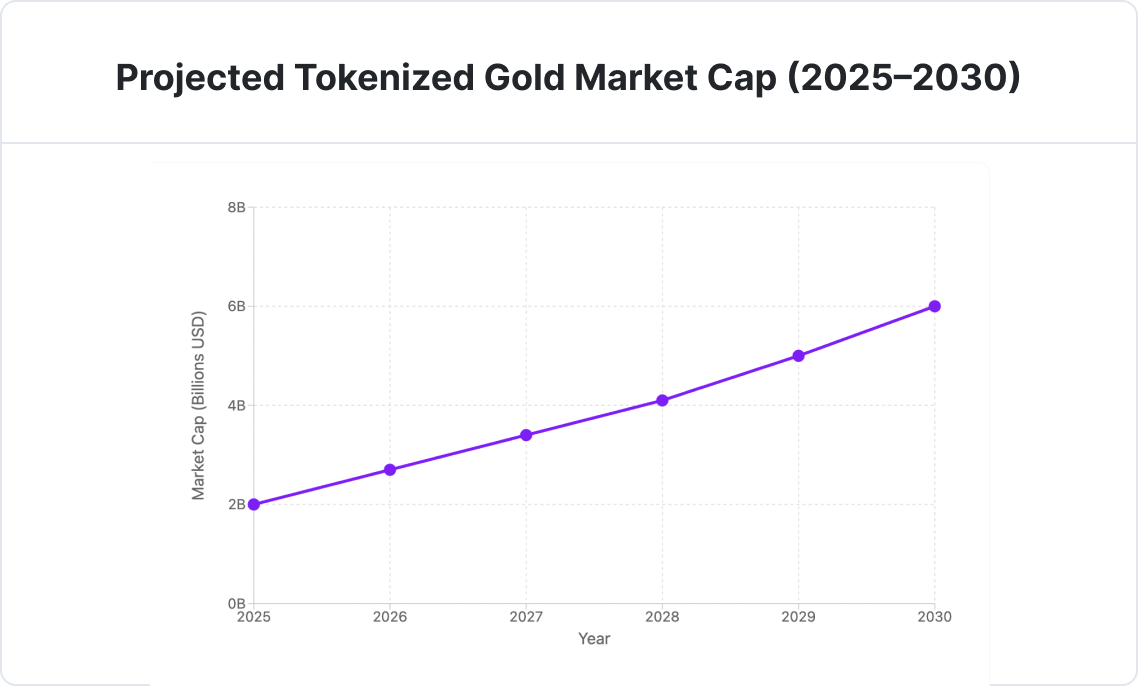

Tokenized gold is projected to reach $6B by 2030, if made usable.

Tokenized gold has grown from $160M in 2020 to $2B in 2025, with forecasts projecting $6B by 2030—if utility is unlocked. This trajectory signals strong demand, but future growth hinges on activating function: yield, composability, and deep DeFi integration. Gold already dominates tokenized commodities. Turning it into productive capital sets the standard for the entire RWA sector.

Tokenized Gold and the Broader RWA Landscape

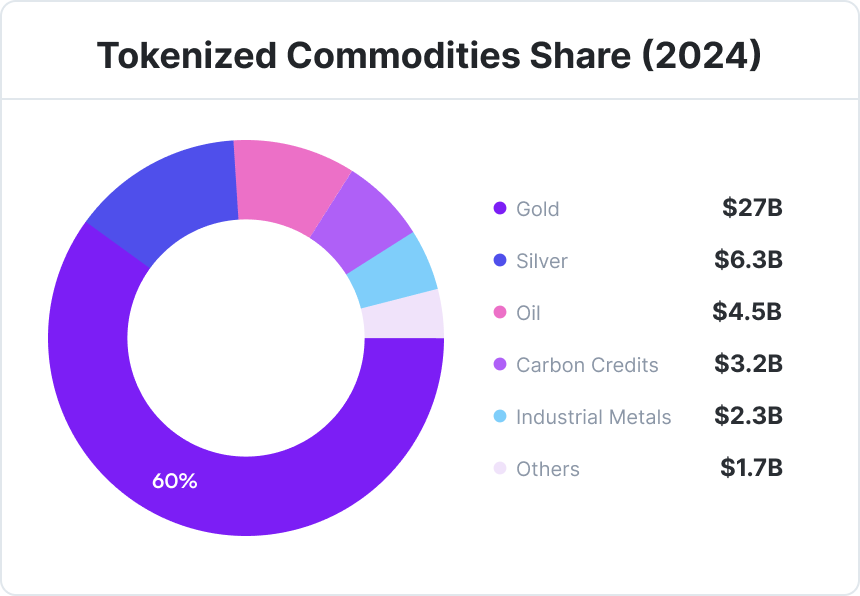

Gold leads all tokenized commodities, but few are actively used in DeFi.

In 2024, tokenized commodities reached $45B, with gold accounting for over 60% of the total. And yet, most of that value remains unused in DeFi. If the most trusted and liquid RWA can’t find utility onchain, what hope is there for tokenized bonds, real estate, or carbon credits? Gold isn’t just another asset—it’s the benchmark. Making it usable isn’t a nice-to-have. It’s the proving ground for the future of onchain finance.

How Cables Solves It

Cables is built to make real-world assets like gold usable onchain—not just tokenized, but functional. Most RWA projects stop at representation. Cables goes further by transforming idle assets into productive capital. cabXAU is the first example: a fully-backed, yield-bearing tokenized gold asset designed for active participation. Users can mint cabXAU with collateral, earn yield through real-world financial strategies, and use it across DeFi for staking, vaults, and swaps.

This is the new standard. Not passive, not speculative, but purposeful. Cables is laying the foundation for a utility-first RWA economy, where every asset earns, integrates, and evolves onchain.

Share this article: