Share this article:

The Current State of RWAs Onchain: What’s Live, What’s Missing, and Where It’s Going

Bringing real-world assets (RWAs) onchain has opened new ways for capital to move. What began as isolated experiments has become a growing market where public blockchains support tokenized treasuries, gold, equities, and credit products. This shift has already started reshaping how value flows and how markets function.

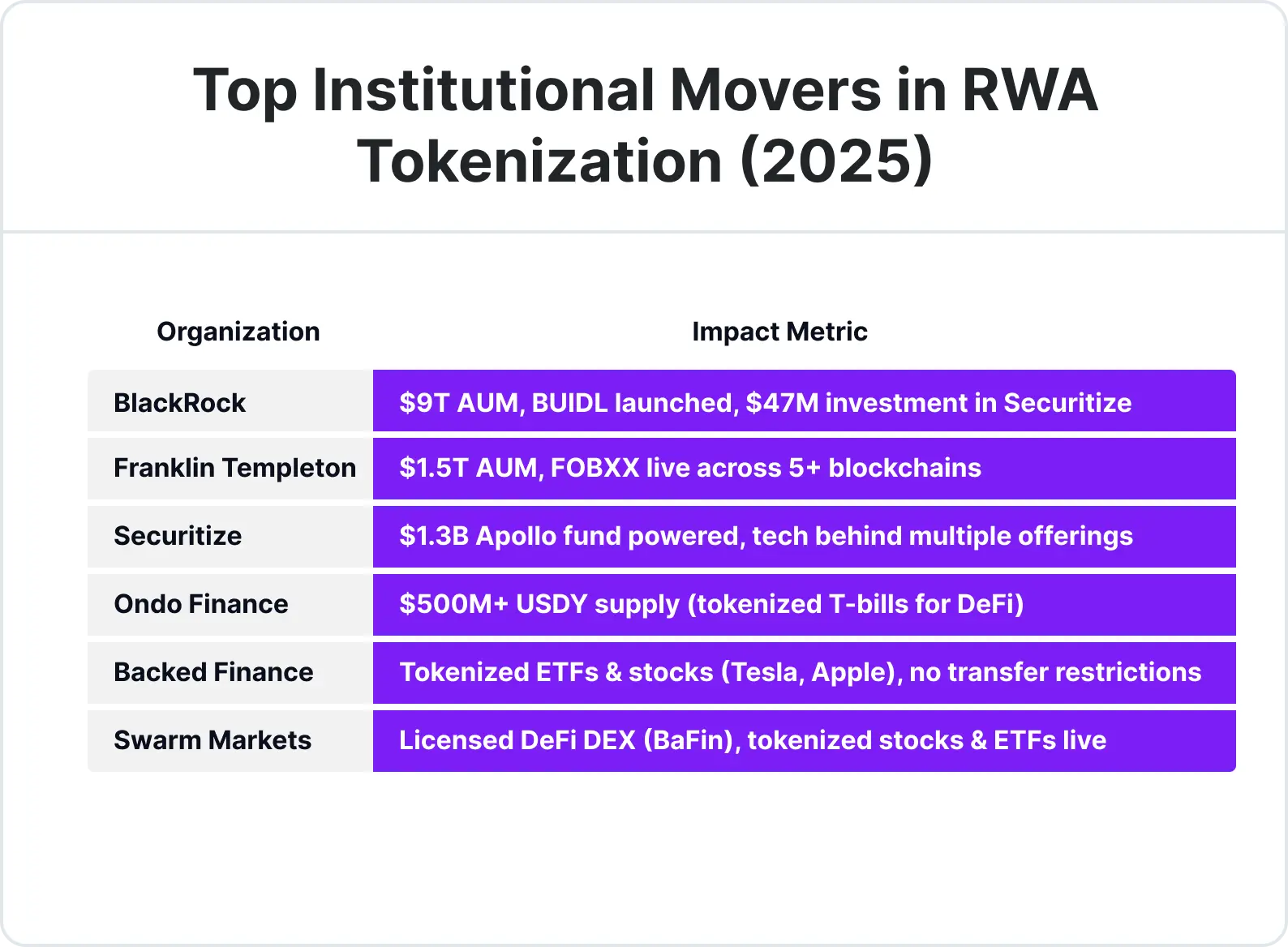

Institutional heavyweights like BlackRock, Franklin Templeton, and Citi are no longer observing from the sidelines. They are tokenizing real assets and integrating blockchain-based settlement into traditional financial systems. RWAs are becoming a new layer of market infrastructure, not just an alternative to existing instruments.

Yet progress remains uneven. Many RWA projects remain isolated, disconnected from the activity that powers real liquidity, staking, and trading. While the existence proof is complete, utility is still out of reach for most users. The market has traction, but it lacks motion.

What’s Live and Working Today

Skeptics have grown quiet. The numbers tell the story.

Tokenized treasuries now exceed $1.5 billion in circulation. Issuers like Ondo, Matrixdock, and Maple provide reliable access to government debt with onchain settlement. These assets offer steady yields without the complexity of legacy markets.

In commodities, gold-backed tokens have built real traction. PAX Gold alone holds over $600 million in market capitalization. Credit and real estate pioneers such as Centrifuge and Goldfinch have facilitated over $350 million in real-world asset financing. These platforms connect capital-seeking borrowers with DeFi liquidity, opening new financial pathways.

Stablecoins remain the largest proof of concept. USDC and USDT process billions in daily volume. While often excluded from RWA discussions, they represent the earliest and most successful tokenization model.

By mid-2025, tokenized RWAs now account for over $15 billion in value. Institutional growth remains strong, and retail participation is beginning to follow.

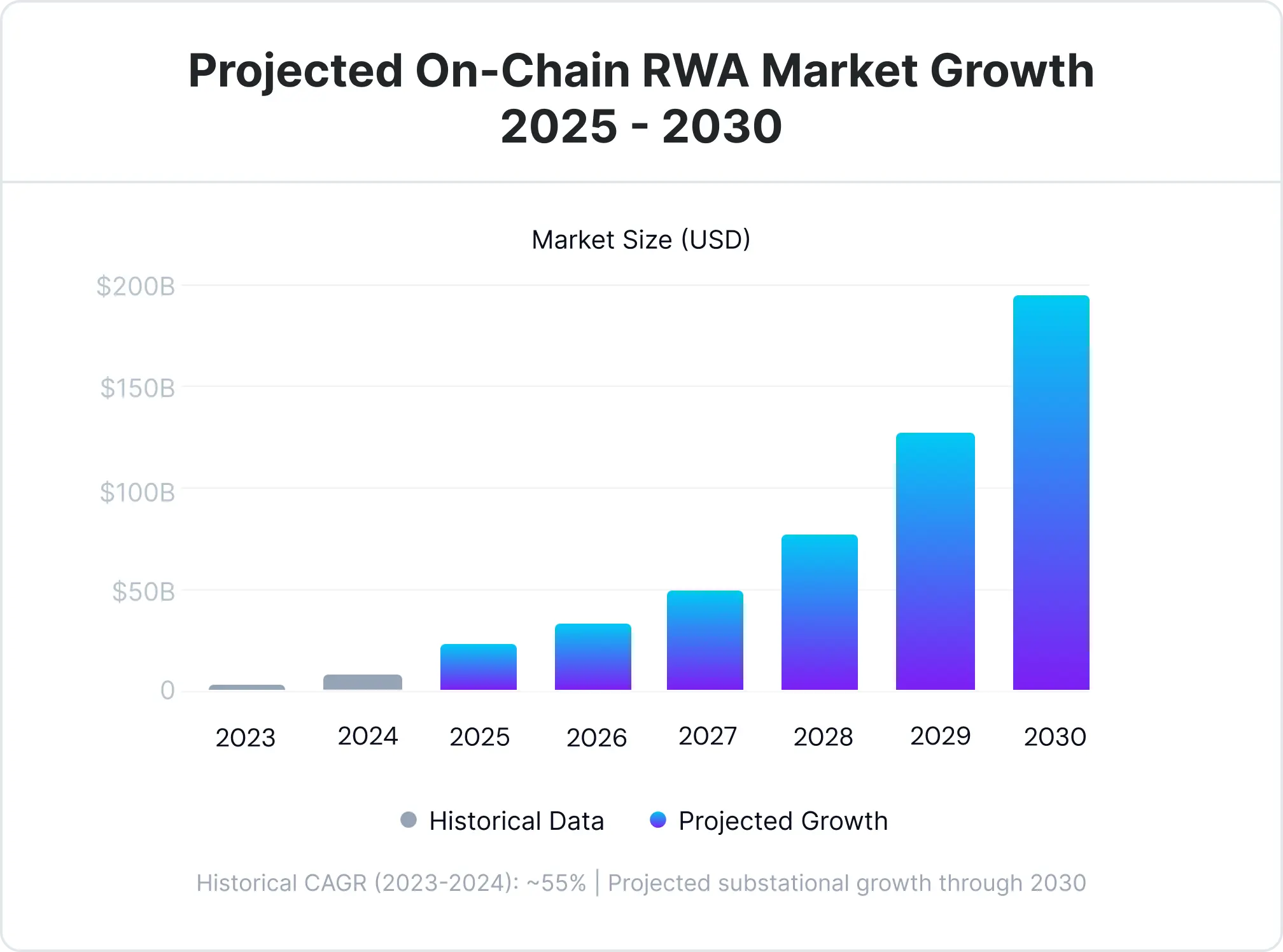

Growth Projections: Billions Today, Hundreds of Billions Tomorrow

The growth trajectory for RWAs onchain is accelerating fast. While the market surpassed $15 billion in tokenized real-world assets by early 2025, projections suggest that figure could climb past $200 billion by 2030. Historical growth rates of ~55% annually (2023–2024) already outpaced early expectations, driven by the success of tokenized treasuries, commodities, and credit markets.

Institutional participation, improved regulatory clarity, and the maturing of DeFi infrastructure are expected to fuel this next wave. As more RWAs become composable across lending, trading, and staking ecosystems, their utility—and therefore adoption—will multiply. The shift from passive holdings to active financial primitives is setting the stage for exponential capital inflows.

Different Models, Same Mission

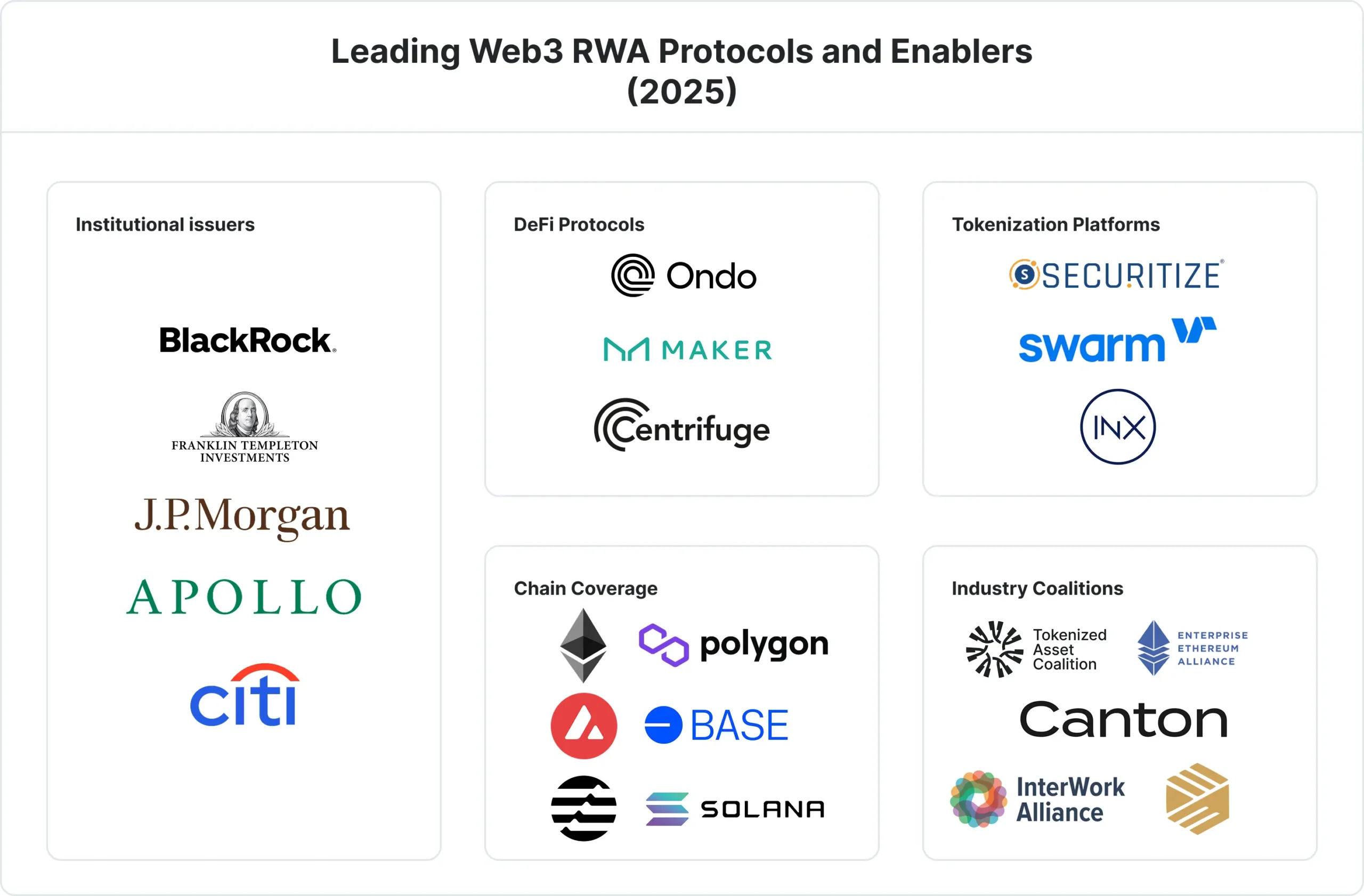

The RWA sector has expanded from early-stage experiments into a diverse set of models serving different segments of the market.

Fixed income and treasuries were the first wave. Platforms like Ondo and Matrixdock created tokenized access to government securities, offering institutions an easy onchain entry point with low-risk yield opportunities.

A second wave focused on financial inclusion. Projects like Goldfinch are creating credit access in markets where traditional finance has failed, not by wrapping existing assets but by establishing new financial pathways that previously did not exist.

Infrastructure builders make up the third category. Centrifuge and others have built systems for tokenizing illiquid assets such as invoices and real estate. These platforms do not issue assets themselves. Instead, they provide the foundational rails that others use to bring value onchain.

Meanwhile, leading DeFi protocols are moving into the space. MakerDAO’s Endgame Plan, which allocates hundreds of millions into real-world collateral, reflects a growing shift. Real-world value is becoming the backbone for onchain stability.

Institutions are no longer on the sidelines. Major players like BlackRock, Franklin Templeton, and Securitize have launched tokenized products or built infrastructure that supports the sector’s growth. These movers represent the next phase of adoption—where traditional capital meets DeFi’s efficiency.

The Usability Bottleneck: Capital Is Ready, But Locked

While tokenization has advanced, usability still lags behind. Most RWAs today are static holdings, not functional financial tools. For retail users, this creates a familiar frustration. Assets often sit idle in wallets because the pathways into lending, trading, or staking remain complex or nonexistent.

Someone holding tokenized treasuries, for example, who wants to use them as trading collateral typically must exit the position entirely, bridge assets to another platform, and sacrifice yield along the way. Liquidity fragmentation only deepens this problem. Even the most mature RWAs rarely function as reliable collateral for trading or leverage. Regulatory barriers, permissioned pools, and strict KYC requirements further limit composability.

DeFi promised capital efficiency without friction. RWAs haven’t delivered on that promise—yet. Most tokenized assets still require wrappers, bridges, or complex workarounds to move across platforms. These solutions introduce cost, risk, and technical overhead, leaving much of the capital trapped in passive holdings.

The opportunity is obvious. For RWAs to reach their full potential, they must function like other financial primitives—moving easily between staking, trading, and collateral systems without unnecessary compromise. Some projects are starting to address this, but a unified solution remains elusive.

Moving from Static to Dynamic RWAs

Liquid staking tokens offer a model for what comes next. Staked ETH was once locked and unusable. LSTs transformed it into a productive asset. Today, staked ETH can power lending, trading, and liquidity provision across the ecosystem.

RWAs are poised for a similar shift. The next phase requires infrastructure that connects staking, collateral, and trading within a single environment.

Cables is building this solution. By combining liquid staking for RWAs with a perpetual futures DEX, Cables enables real-world assets to stay productive across multiple use cases. Staked RWAs will generate yield, serve as collateral, and support trading positions without forcing users to split or move capital between protocols.

This approach removes the false choice between earning yield and maintaining liquidity. It creates a system where assets can work harder across more applications.

The Path Ahead: Why Cables Is Positioned to Lead

The growth of RWAs onchain is no longer hypothetical. Adoption is scaling. Institutional and retail interest is rising. But the next phase of success will not be measured by how many assets get tokenized. It will be measured by how well those assets can be used.

This is where Cables stands apart. We are not adding another tokenization layer to the market. We are building the infrastructure that connects tokenized RWAs to real financial strategies. Staking. Collateral. Trading. Liquidity.

The future belongs to platforms that can make RWAs productive, composable, and accessible to both advanced traders and the broader DeFi community. Our Points Program has already attracted thousands of early participants. Our

liquidity architecture integrates liquid staking and perpetual futures, solving the usability gap that holds back RWA growth.

As more capital moves onchain – across FX, commodities, and yield-bearing RWAs – Cables will be the platform where that capital can work harder and move freely. The opportunity is clear. The infrastructure is coming online. And Cables is ready to connect users and markets to the next $200 billion in tokenized value.

Share this article: