Summarize with AI:

Why RWAs Will Be the Base Layer of the Next Onchain Economy

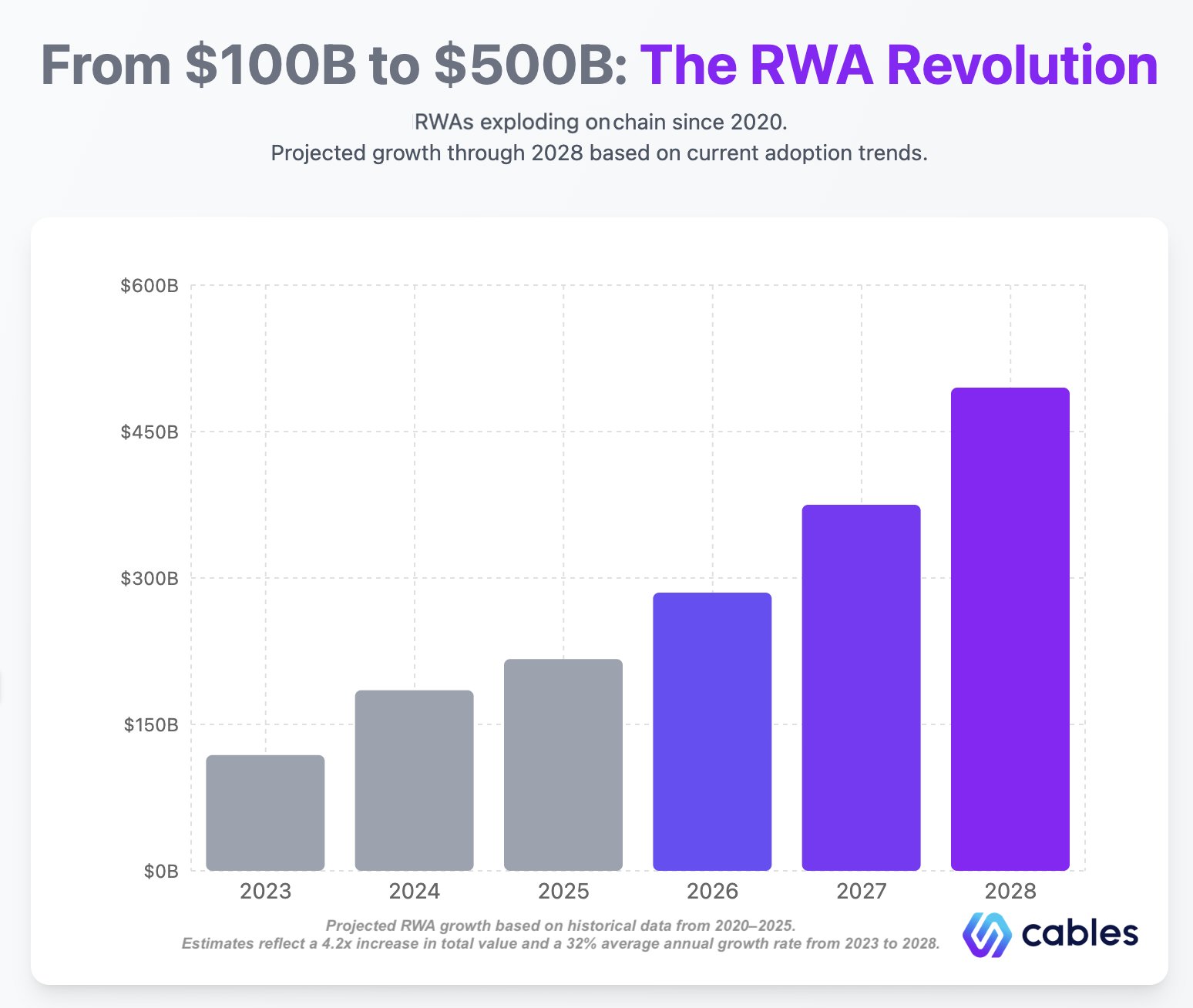

The onchain economy is rapidly evolving, projected to reach $500B by 2028, and real-world assets (RWAs) are emerging as its foundational layer. As institutions and innovators seek new ways to unlock value, Cables Finance is at the forefront of enabling the seamless integration of RWAs into blockchain ecosystems. This article explores why RWAs are poised to transform the digital asset landscape and what it means for the future of finance.

The Rise of RWAs in the Onchain Economy

RWAs represent a paradigm shift in how value is created, transferred, and managed. By tokenizing physical and traditional financial assets, such as currencies, commodities, equities, bonds, real estate, intellectual property, and energy, blockchain technology enables unprecedented liquidity, transparency, and accessibility. The market for tokenized RWAs is expanding rapidly, with major financial institutions and technology providers like Chainlink driving adoption and infrastructure development.

Unlocking Liquidity and Access

Tokenized RWAs break down barriers to entry, allowing a broader range of participants to access previously illiquid or restricted assets. Fractional ownership and global market reach are now possible, creating new opportunities for both investors and issuers.

Programmability and Shared Ownership

The programmability of blockchain-based RWAs enables innovative financial products, such as programmable yield and agent-readable assets. Shared ownership models are becoming more prevalent, allowing for greater flexibility and customization in portfolio construction.

Institutional Adoption and Infrastructure

Institutions are increasingly embracing RWAs as a means to enhance efficiency, reduce risk, and tap into new revenue streams. Robust infrastructure, including secure custody solutions and cross-chain interoperability, is essential for scaling RWA adoption across industries.

The World’s Largest Markets are Next

Real-world assets aren’t limited to tokenized treasuries or real estate—they include the deepest financial markets in the world: foreign exchange (FX) and commodities. Daily FX trading volume exceeds $7.5 trillion, and commodities like gold, oil, and industrial metals represent vast pools of value currently siloed in traditional finance.

Bringing even a fraction of this activity on-chain has the potential to transform DeFi’s scale and utility. Tokenized currencies such as EUR, JPY, and GBP enable global trading, hedging, and borrowing without exposure to USD volatility. Meanwhile, tokenized commodities open up programmatic exposure to inflation hedges and global demand cycles.

The Numbers Tell the Story: RWA Market Trajectory

According to current adoption trends, the onchain RWA market is projected to grow from $100B to $500B by 2028, representing a 4.2x increase in total value and a 32% average annual growth rate between 2023 and 2028. This growth isn’t hypothetical. RWAs have already been exploding onchain since 2020, driven by tokenized versions of Gold, Yen, Euro, and Equities. As traditional finance moves toward programmable, onchain infrastructure, the pace is accelerating.

RWAs are set to revolutionize sectors such as intellectual property, energy, and supply chain management. The integration of AI agents and onchain fund infrastructure will further accelerate the adoption of RWAs, enabling real-time, autonomous economic activity. As regulatory frameworks mature and technology advances, the onchain economy will become increasingly reliant on RWAs as its base layer.

Conclusion

Tokenized Real-World Assets (RWAs) are unlocking new financial opportunities by bridging traditional and decentralized markets. With benefits such as improved liquidity, transparency, and global access, RWAs are set to reshape financial markets and expand DeFi’s reach beyond crypto-native assets. However, overcoming regulatory and security challenges will be key to ensuring their mainstream adoption.

Cables Finance is bringing real-world assets on-chain, making it possible to earn, trade, and hedge with assets like currencies and commodities—all without relying on banks. Our vision is to break DeFi out of its USD bubble and unlock global markets, giving anyone, anywhere, access to real financial opportunities. We’re building the next generation of decentralized finance, where traditional markets and Web3 finally connect.

Share this article: